2020 Gets Blurry: Pandemic & Quarantine Dominate Life, School

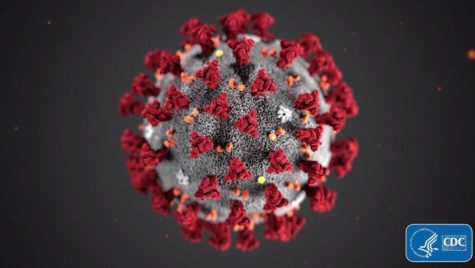

STANWICH ROAD – COVID-19 has taken the world by storm over the past few months. In the United States, there have been stay-at-home orders and people practicing social distancing, which means that a lot of businesses have had to close temporarily – or so they hope.

Schools had to lock their doors. Packets and zoom classrooms took over.

Masks became common. Six-feet became the most well known gap in America.

This all will have profound effects on wealth commonly and individual family outlooks specifically. From school to business, the winter and spring of 2020 will be remembered for giant structural and lifestyle changes by an unprecedented number of people with resounding effects.

Schools sent their students home. Campus lives came to a screeching halt as college and boarding schools shifted home. Day schools like GCDS moved online. While schools’ primary purpose is the education of the youth to be productive members of a growing economic structure, schools also serve – to be frank – as day care centers for minors of all ages so that parents can go to work. With schools closing, younger kids needing parents to help home school so that instruction disruption is minimal, many parents are now unable to maintain the level of work commitment as before.

For students graduating, estimated by the Education Department as 3.7 million 12th graders nationwide, the spring of 2020 went from a rite of passage and time of celebration and commencement, to a time of isolation and cancelled events. GCDS will graduate its first 12th grade class, a group of a dozen students who already transitioned from one school, Stanwich, to another – and now had a new variable thrown into their schooling careers.

And careers for those students, and ones finishing college are another stormy outlook.

Due to COVID-19, the unemployment rate has skyrocketed and it is at the highest since the time students learn about in the history books. That period, The Great Depression of the 1930’s was marked by prolonged economic struggles.

Current stats suggest an unemployment rate of at least 15% nationally, which means the real jobless rate is likely higher, and underemployment will become another issue. The higher the unemployment rate, the more money the government has to spend on benefits, Medicaid and food assistance and according to Investopedia.com. This will come at a time when tax revenues will fall due to less spending and loss of jobs.

Mortgage, car, rentals, utilities, and other essential payments may be severely delayed, which has ripple effects.

Some Brick and Mortar stores have filed for bankruptcy in the past few weeks because they have already been declining in popularity prior to COVID-19 due to the growth of online shopping and easy accessibility of Amazon. For some brick and mortar stores COVID-19 was the last strike, as stores like JCPenney, Neiman Marcus, and J. Crew has filed for bankruptcy. Other companies like Lord and Taylor, Kohl’s, Macy’s, and Bloomingdales are being watched carefully and might have to file for bankruptcy in the upcoming weeks or months.

Some states like Connecticut have recently started Phase One of reopening the state, which means that more business will open and eventually things will hopefully go somewhat back to normal. The economy will slowly build itself back up, but it could take years for the economy to fully recover from the damages and go back to the way the economy ran prior to COVID-19.

David-Jared Matthews is a rising Senior who enjoys writing, learning new things, theatre, and sports. He is excited to write for the newspaper again and help to be a voice to spread information going forward.